Donate Product

Donate Product

Delivering Good provides manufacturers and retailers an efficient and sustainable way to use their excess merchandise to help those in need. Whether you are thinking of donating merchandise to help those stricken by poverty, or to provide disaster relief, or you just can’t find a buyer for excess product, we can help you by connecting your merchandise to communities in need across the US.

The donation process is simple. Submit a donation form by clicking on the Donate Product button below, and we will contact you to coordinate delivery.

Product Campaigns & Promotions

Delivering Good runs several campaigns each year to collect the items most needed by the communities we serve.

Benefits of Donating Product

Consumers Favor Companies that Give Back

- 93% of U.S. consumers have a more positive image of a company if it supports a cause

- 90% of Americans are more likely to trust and be loyal to companies that back causes

- 54% of Americans bought a product associated with a cause over the last 12 months, up 170% since 1993

- Align your brand or company with a good cause

- Receive tax breaks for your donations (consult your tax advisor)

- Eliminate warehousing costs for excess inventory

- Gain visibility among industry leaders and press

- Help your consumers feel good about purchasing your products

- 93% of U.S. consumers have a more positive image of a company if it supports a cause

- 90% of Americans are more likely to trust and be loyal to companies that back causes

- 54% of Americans bought a product associated with a cause over the last 12 months, up 170% since 1993

What To Donate

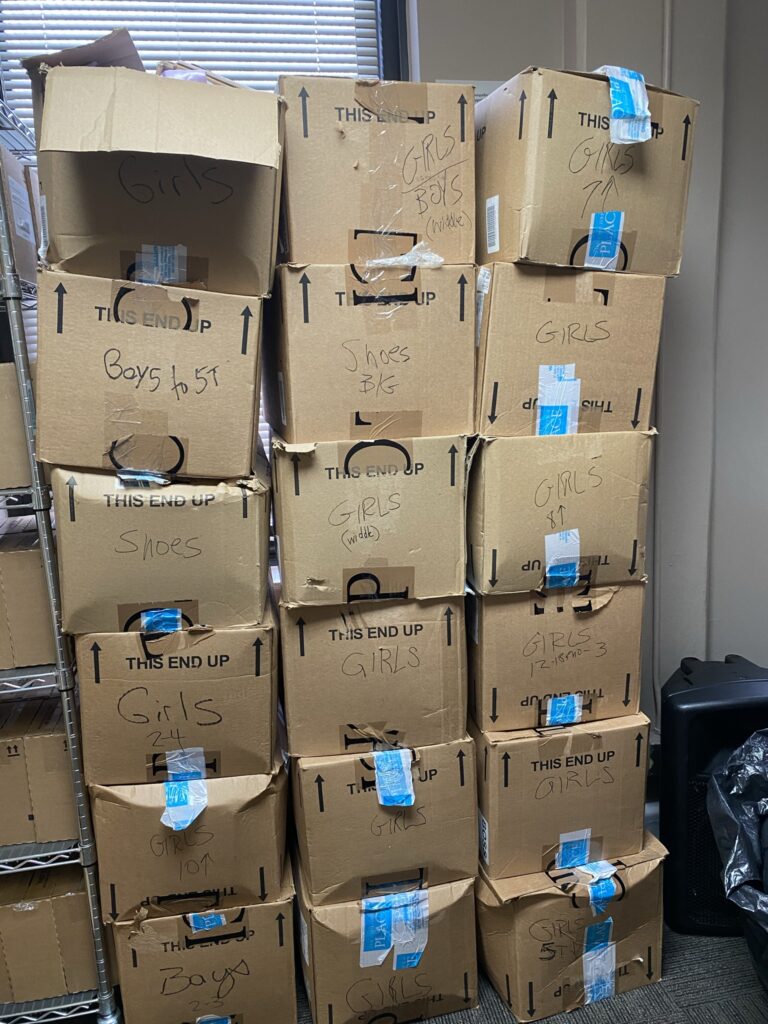

Delivering Good only accepts donations of new products, but there is no limit to the size of the donations accepted; we can easily find a use for one box of samples or an entire truckload of merchandise. Our network of community partners distributes donated items quickly and directly to those in need; all of our partners are registered as tax exempt 501(c)(3) nonprofits.

All merchandise is provided free of charge to recipients.

While donations of all types of new products are welcome, certain items are

always in demand by our community partners, including:

- Men’s, women’s and children’s apparel, shoes, socks and accessories

- Home items including sheets, towels and blankets

- Juvenile products such as cribs and strollers

- Toys

- Books

Service Fees

As of August 31, 2020, Delivering Good initiated a new set of service fees to help support our charitable mission.

- We are asking product donors to cover the cost of shipping their donations.

- If paying for freight costs is not feasible for the donor, there are a set of modest fees, based on the services needed.

- A flat fee of $500-$1,000 per shipment, regardless of the size of the shipment, for any shipment where donors are unable to pay for freight costs.

Product Donors

Delivering Good receives donations of new product from a range of companies who choose to do good with their excess merchandise – a win for our people and our planet! In 2022, more than 250 generous companies donated nearly 16 million units of new merchandise valued at more than $154 million.

A and J Apparel Corp

Accessories Design Group, LLC

Aden & Anais, Inc.

Adrianna Papell

AEO Inc

Aeropostale

AKOFIKO LLC

Alzheimer’s Drug Discovery Foundation

American Eagle Outfitters

American Girl/Mattel

Amtrak

Anew Legwear LLC

Arvin Goods LLC

Aterian Group, Inc

Aunt Fannie’s

Aurora Sky, LLC

Autumn Communications

Ayablu, Inc.

AYK International

Baby Boldly

Banana Panda

BAROQUE USA LIMITED

Bbase International Design

BBC Retail & Internet LLC

BCI Brands LLC

BE for Beauty Ltd.

Behrman Communications

Bentex Group Inc

Bentley University

Berkshire Fashions Inc.

Beyond Words Publishing, Inc.

Bianca Freda LLC

Bijoux International Inc.

Binky Bro LLC

Birmingham Ministries

Bivona & Company

Bombas

Boys Lie, LLC

Bradford Hammacher Group

Bravado International Group

Britax Child Safety, Inc.

BUENA VISTA THEATRICAL GROUP, LTD.

Burlington Stores, Inc.

BurtsBees Baby/Ayablu Incorporated

Bux & Bewl Communications

C3 Presents / LiveNation

Capri Holdings Limited

Carter’s, Inc.

Centric Beauty LLC

Centric Brands

Children’s Apparel Network

CHUX Print

City Threads

Club Monaco

Coach

Collibra, Inc.

Commando LLC

Communaute LLC

Cottage Dou Press

Cuddl Duds

dadada Baby

Dayang Alliance

DECOR GLOBAL INC

Delta Children

Delta Galil USA, Inc.

Disney Consumer Products and Interactive Media

DIZZY LIZZIE LLC

Dormify, Inc.

Douglas Co. Inc

Dynatrace LLC

ELIZABETH ALLEN ATELIER

ELOQUII Design, Inc

Epic Rights – Universal Music Group

Estee Lauder Companies

Exxel Outdoors, LLC

Foot Locker, INC

Foundation

FRAME

Franco Manufacturing Company, Inc.

Freshly Picked

Gerber Childrenswear LLC

Gerber Childrenswear LLC – NC

G-III Apparel Group

Global Brands Group

GMA Accessories Inc

Goldbug, Inc.

Go West Genuine, LLC

Grossman Marketing Group

Gymshark USA Inc.

Hahn Solo Consulting

Hanes Brands, Inc.

Happy Family Designs Inc

Happy Socks North America

Harry J. Rashti & Co., Inc.

Haselson International Trading

HBC

Hello Bello

Heritage Baby Products

High Beauty Inc

Honey Bee Woven LLC

Howler Brothers

Hybrid Apparel

ICER BRANDS

Iconix Brand Group, Inc.

IKEA

Inklings Baby

In Mocean Group, LLC

In The Present

Intradeco Apparel

I Play I Learn Inc.

Italic Labs LC

ITC USA LLC

ItSugar LLC

J.Hilburn

Jailbreak Toys

Jazwares, LLC

JETSETGO LLC

Jet Set Sports LLC

Jockey International, Inc.

Joovy, Inc.

JWE INC

Kassatex Inc

Kate Spade

Kayser-Roth Corporation

KinderCare Learning Companies

Klean Kanteen

Komar

L2 Brands

Lafayette 148 New York

Lane Bryant

Lauer Enterprises Inc.

Lee Rubber Products, LLC

Lenor Romano LLC

Le Petit Lingerie, LLC

Levtex LLC

LF Sourcing (Millwork LLC)

Little Fashions Boutique LLC

Loft

Lotso LLC

Loveshackfancy LLC

M. Hidary & Company, Inc.

MaCher USA

Mad Engine Global LLC

MAGGIE STERN STITCHES, INC

Major League Soccer LLC

Mamiye Brothers, Inc.

Marc Fisher Footwear

Marine Layer Inc.

Martin Schiff Independent Manufacturers Representative

Maurices

Meijer, Inc

Miami Heat Limited Partnership

Michael Kors

Million Dollar Baby

Mobile Showroom LLC

Montasy Comics Chapter 2 Inc.

Moonlight Slumber

MoveOn.org

Multi-Clean

Munchkin, Inc

National Basketball Association

NFL Players Association

Nice-Pak/PDI

Nicholas Kirkwood

Nicholson Corporation

Nicole Miller

NIKE Inc.

Nook Sleep

NYDJ

Oeuf LLC

Oilogic

One Less Nemesis, LLC

Ooh! La, La! Couture

Operation Warm

Outdoor Cap Company, Inc.

Pacific Wave Inc.

Patagonia

Peerless Clothing International

Perfume Partners LLC

Polo Ralph Lauren

Premium Brands Opco LLC fmka Ascena

Primark

Q4 Kids LLC

Qontevo LLC

Rachel Zoe Collections

Rasmussen University

Ralph Lauren

Raw Brands Inc

Raytheon Company

Rebecca Taylor

Regal Lager, Inc.

Regal Lager / Love To Dream

Renfro Corporation

Rent the Runway

Re-play

Reunited Clothing

RGA Leatherworks

RG Barry Corp

Rocking Inc.

RON CORNELL

RSM US LLP

Saint James USA

Salty, Inc.

Sapience Group LLC

Scholastic, Inc.

SoulCycle

Southern Tots

Space Enrich LLC

SPARC Group LLC

Splashlight Studios

Steve Madden LTD

Students Going The Extra Mile

Summit Golf Brands

Swat Fame, Inc.

Tailored Brands

Talbots

Tall Order

Tapestry

Terramar Sports Inc

Tharanco Group, Inc.

The Baby’s Brew

The Children’s Place

The Children’s Place #1081

The Children’s Place #1298

The Children’s Place #1474

The Children’s Place #1930

The Children’s Place #3218

The Children’s Place #3318

The Children’s Place #4389

The Children’s Place #4405

The Children’s Place #681

The Children’s Place #69

The Children’s Place #706

The Children’s Place #714

The Children’s Place #750

The Children’s Place #905

The Children’s Place #984

The Estee Lauder Companies Inc.

The Goodness Project

The Joester Loria Group, LLC

The Rabbit Hole Children’s Boutique, LLC

Tiltworks

Trinity Packaging Supply

TTPM (Toys, Tots, Pets & more)

United Legwear & Apparel Co.

Universal Athletic

Vandale Industries

Vince

Wacoal America, Inc

Walt Disney Studio Home Entertainment

Westwood Design

Williams-Sonoma, Inc

Wipes Plus

WIP Wholesale LLC

Xavier High School

529 LLC